Capital Policy

Overview

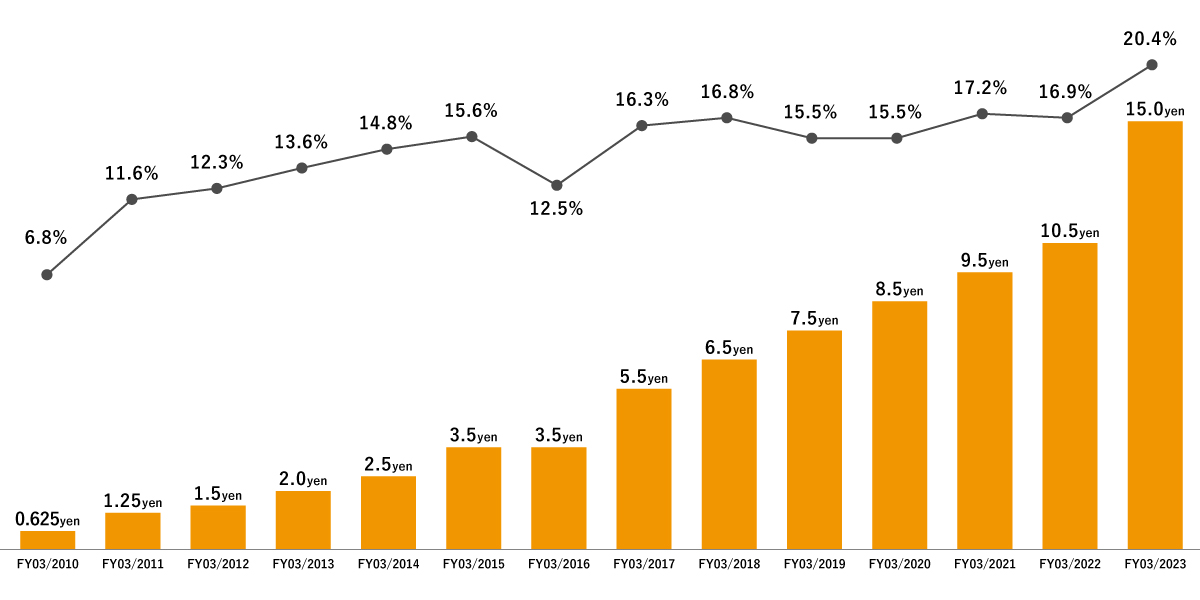

We believe it is essential to contribute to shareholder value by achieving sustainable growth and increasing our corporate value over the long term. We aim to achieve continuous growth in net income, maintaining higher ROE than our cost of equity by efficiently using our limited management resources. As huge business opportunities emerge in the market related to an aging society where we operate, we will use the profits earned to make the necessary investments for sustainable growth and long-term enhancement of corporate value. Therefore, our basic policy for profit distribution is to pay dividends in line with business results for each fiscal year, with a target consolidated dividend payout ratio of 30%, while prioritizing growth investment and considering the financial conditions. However, this does not apply in the event of major investment opportunities such as M&A.

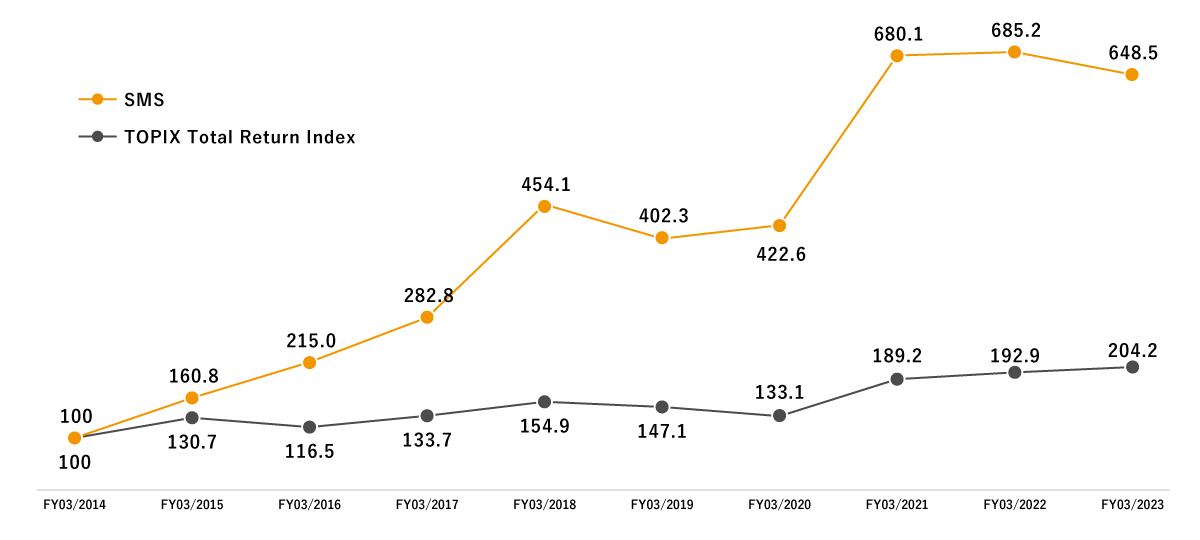

■Total Shareholder Return

- *This total Shareholder Return means the profit generated from all capital gains and dividends from the SMS’s shares during a holding period.

- *The closing price as of March 31, 2014, is set at 100, and the value at the end of each fiscal year is shown if you continue to hold the stock.

■Dividends

Historical Dividend per Share and Payout Ratio

- *Past stock splits are taken into account for the DPS calculation.

■Share Repurchase

Acquisition period

Acquisition method

Number of shares acquired

Total amount

April 30 – May 7, 2024

Market purchase

876,400

1,915,074,100

November 1 – November 8, 2023

Market purchase

853,600

1,999,798,750

February 5 – March 31, 2015

Market purchase

176,600

116,379,900

November 21 – December 31, 2014

Market purchase

470,800

296,464,400

September 19 – September 22, 2014

Market purchase

172,800

120,714,400

April 30 – June 11, 2013

Market purchase

1,275,600

421,009,300

May 1 – May 31, 2012

Market purchase

564,000

81,446,800

Total

-

4,389,800

4,950,887,650

- *Past stock splits are taken into account for the calculation.

| Acquisition period | Acquisition method | Number of shares acquired | Total amount |

|---|---|---|---|

| April 30 – May 7, 2024 | Market purchase | 876,400 | 1,915,074,100 |

| November 1 – November 8, 2023 | Market purchase | 853,600 | 1,999,798,750 |

| February 5 – March 31, 2015 | Market purchase | 176,600 | 116,379,900 |

| November 21 – December 31, 2014 | Market purchase | 470,800 | 296,464,400 |

| September 19 – September 22, 2014 | Market purchase | 172,800 | 120,714,400 |

| April 30 – June 11, 2013 | Market purchase | 1,275,600 | 421,009,300 |

| May 1 – May 31, 2012 | Market purchase | 564,000 | 81,446,800 |

| Total | - | 4,389,800 | 4,950,887,650 |

- *Past stock splits are taken into account for the calculation.