Corporate Governance

■Basic Views

Based on the mission (Group Mission) of SMS and its subsidiaries (Group) of improving people’s quality of life by providing information infrastructure for an aging society, the Group strives to achieve sustainable growth and increase its corporate value over the long term by valuing all stakeholders including shareholders, customers, business partners, employees, and local communities. The markets for medical care, elderly care, healthcare, and senior life, which are the business domains of the Group, are growing at an accelerating pace and changing rapidly. Therefore, the Company must make swift and decisive management decisions. At the same time, it is essential to build a sound management system with transparency and fairness to earn the trust of all stakeholders.

Corporate governance is a framework for achieving transparent, fair, and swift management decision-making. The Company believes it is important to ensure effective corporate governance to realize the Group Mission and increase its corporate value over the long term. Based on this recognition, the Company will achieve effective corporate governance through the following basic policies:

(1) Ensuring the Rights of and Equality among Shareholders

(i) Ensuring the Rights of Shareholders

The Company discloses information in a timely and appropriate manner and strives to improve the environment in which shareholders can exert their rights to ensure substantial equality among all shareholders, including minority and/or foreign shareholders and the appropriate exercise of their rights.

(ii) General Shareholders Meetings

The Company believes that a General Shareholders Meeting is an opportunity for constructive dialogue with shareholders. To enable the shareholders to exercise their voting rights appropriately, the Company provides notices with accurate information on voting on the Company website days ahead.

(iii) Capital Policy

The Company believes it is essential to contribute to shareholder importance value by achieving sustainable growth and increasing its corporate value over the long term. The Company aims to achieve continuous EPS growth and maintain higher ROE than its cost of equity by efficiently utilizing its limited management resources. As huge business opportunities emerge in the market related to an aging society where the Group operates, the Company will use its profits for the investments necessary for sustainable growth and long-term corporate value enhancement.

Capital policies that may affect the rights of existing shareholders, such as large-scale capital increases, shall be conducted through appropriate procedures based on a thorough consideration of its necessity and rationality not to harm the rights of shareholders unduly.

The Company's basic policy for profit distribution is to pay dividends in line with business results for each fiscal year, with a target consolidated dividend payout ratio of 30%, while prioritizing growth investment and considering the financial conditions. However, this does not apply in the event of major investment opportunities such as M&A.

(iv) Cross-Shareholdings

The Company does not hold any listed shares under a so-called “cross-shareholdings” structure. The Company will not hold such shares if it is not possible to reasonably explain that such shares will lead to long-term enhancement of corporate value after comprehensive considerations of factors including consistency with the Group's strategy, synergy effects, and risks.

(v) Adoption of Takeover Response Policies (or Anti-Takeover Measures)

The Company believes that achieving sustainable growth and long-term enhancement of corporate value and building good relationships with shareholders and investors through IR activities will lead to defend against hostile takeovers. Therefore, the Company has not adopted takeover response policies (anti-takeover measures.)

(vi) Related Party Transactions

The Company conducts all transactions through the necessary screening and approval process depending on the transaction scale and significance following internal regulations.

Any transaction which may cause conflicts of interest is subject to the prior approval of the Board of Directors and is required to be reported to the Board after it is carried out.

Related party transactions are conducted by taking into account the general terms and conditions of transactions in the market, and the status of such transactions is monitored to prevent any disadvantages to the Company. The Company discloses related party transactions in the annual securities report and non-consolidated financial statements attached to the convocation notice for the General Shareholders Meeting.

(2) Appropriate Cooperation with Stakeholders Other Than Shareholders

The Group Mission states that the Company aims to continue contributing to society through its business activities. To this end, it is essential to build good relationships and cooperate with all stakeholders, including shareholders, customers, business partners, employees, and local communities. The Company's basic stance toward each stakeholder is as follows:

- For customers: The Company values customers (operators, workers, and end-users) through its information-based services.

- For business partners: The Company builds sound coexistence relationships with business partners by procuring products and services of appropriate quality at appropriate prices.

- For employees: The Company provides employees with various growth opportunities through the sustainable growth of its business and aims for mutual development between the Company and employees.

- For local communities: The Company contributes to the sustainable development of local communities by solving various social issues that arise in an aging society through its business activities.

(3) Ensuring Appropriate Information Disclosure and Transparency

The Company believes that it has the responsibility to disclose appropriate information on a timely basis and sufficiently fulfill its accountability. In addition to ensuring disclosures in compliance with relevant laws and regulations, including the Companies Act, the Financial Instruments and Exchange Act, and the rules of the Tokyo Stock Exchange, the Company discloses information that may affect the investment decisions of shareholders and investors, in a timely and appropriate manner.

(4) Responsibilities of the Board of Directors

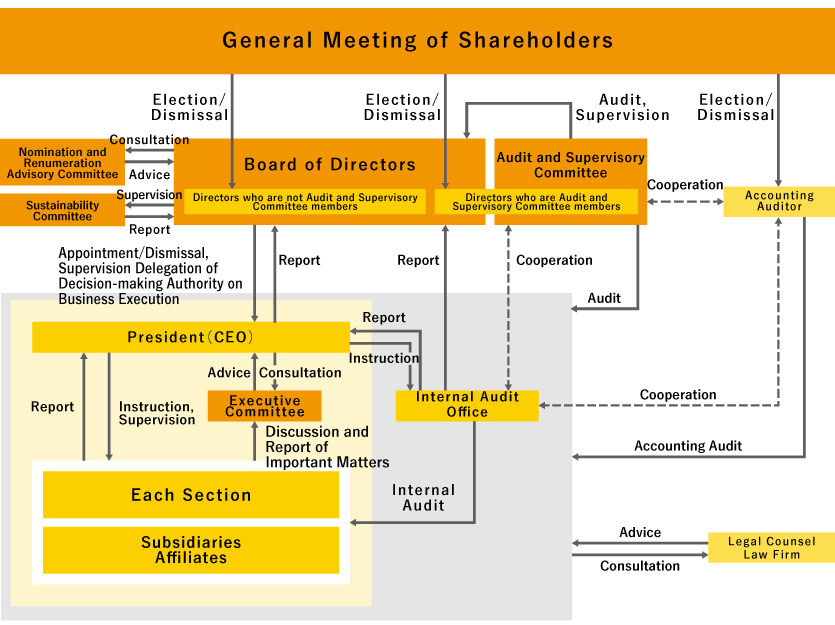

As a Company operating in a market that is accelerating and changing rapidly, it is imperative to build a management system that enables swift and sound management decisions in a timely and appropriate manner to realize the Group Mission and increase its corporate value over the long term. Therefore, the Company has adopted an organizational form of a company with an Audit and Supervisory Committee and the authority of the business execution of the Board of Directors has been delegated to the Representative Director and President (CEO), and other Directors. The Board of Directors focuses on substantial discussions regarding management strategies and issues from a broader perspective and enhances its supervisory function over business execution. At the Audit and Supervisory Committee, the Committee members who have the voting rights of the Board of Directors (all are Independent Outside Directors) conduct audits to improve the effectiveness of audit and supervision. The Company has also established the Nomination and Remuneration Advisory Committee to ensure objectivity, fairness, and transparency in the nomination of Director candidates, the appointment/dismissal of the senior management, and the remuneration decision for Directors who are not the Audit and Supervisory Committee members. To realize the most appropriate composition of the Board of Directors suitable for a rapidly changing business environment, the Company has set the policy for the nomination of Director that requires candidates a deep understanding of the Company's business along with a wealth of experience and broad insight in areas such as finance, accounting, legal affairs, and corporate management, regardless of age, gender, or nationality. Specifically, the Company aims to achieve diversity among the members of the Board of Directors in terms of their backgrounds, areas of expertise, and international experience. In addition, for Outside Directors who are the Audit and Supervisory Committee members, the Company aims to achieve diversity in terms of tenure to harmonize the experience of long-serving Directors with the fresh perspectives of the new Directors. The Company believes that the above system enables the Directors to fulfill their duties.

Thereby the Company will realize the Group Mission and increase its corporate value over the long term.

(5) Dialogue with Shareholders

The Company recognizes that it must engage in constructive dialogue with shareholders and investors with a long-term perspective to realize the Group Mission and increase its corporate value over the long term. Therefore, the Director of Corporate Management supervises dialogue with shareholders, and the policy of the dialogue is decided in cooperation with the CEO. The CEO explains the management strategies and the business conditions at quarterly results briefings and actively participates in IR interviews. In addition, opportunities for dialogue between Outside Directors and shareholders are provided as necessary.

<Corporate Governance Structure>

■Corporate Governance Report

Corporate Governance Report

(Last update: September 18, 2024)